ricky_005

Basic Member

Posts:313

|

| 13 Dec 2014 01:11 PM |

|

Oil prices are expected for the next several years to remain far below the $100 a barrel mark. Today oil its trading in the $57 range and still cant seem to find a bottom. I personally think oil will find a footing in the $50 to $60 average for the next several years.

Building materials which all have oil in some form of fashion attached to it, should start to soften up on price....

Whats your thoughts?

|

|

|

|

|

|

|

tjetson

New Member

Posts:52

|

| 13 Dec 2014 04:35 PM |

|

let the good times roll? 8000sqft plus houses with no insulation!

|

|

|

|

|

Bryan1978

New Member

Posts:39

|

| 13 Dec 2014 10:59 PM |

|

Maybe, but unlikely. Reason being that now the transportation company may not drop their price as fast or at all. We all got use to current prices so everyone like utilities to airlines are going to take advantage of this situation while it last. Take milk for example, gas was 4.25 a gallon and milk companies raised their prices. How much has milk dropped since oil peaked years ago. |

|

|

|

|

jdebree

Basic Member

Posts:497

|

| 14 Dec 2014 06:36 AM |

|

Concrete prices are up a bit in our area lately. Not sure what's driving that, other than demand. I got great deals on building materials a few years ago when the industry was in collapse, especially in FL. Now that building is moving again, prices have firmed up. I need to have some fill dirt trucked in this spring; hopefully, lower fuel prices will get me a break on hauling charges, but I doubt it. |

|

|

|

|

sailawayrb

Veteran Member

Posts:2272

|

| 14 Dec 2014 10:24 AM |

|

While one could hope that intelligence would prevail over greed and we would see a permanent trend of declining fossil fuel demand/prices, the reality is that the Republicans will be back in charge next month. The best ROI move right now would be to buy oil ETFs. |

|

| Borst Engineering & Construction LLC - Competence, Integrity and Professionalism are integral to all that we do! |

|

|

uerling

New Member

Posts:22

|

| 15 Dec 2014 07:58 AM |

|

The wells around here shut down at 65 and have a 15 year payoff at 67 so I'm thinking the glut of supply will not last.

|

|

|

|

|

Dana1

Senior Member

Posts:6991

|

| 15 Dec 2014 12:17 PM |

|

Anybody making oil price predictions "...for the next several years..." is simply making stuff up, even if it eventually turns out to be the case. Hang onto your wallet and walk away!

If China & India's growth picks up, and if Europes economy recovers, oil demand will rise to prior levels, further driving prices. Deals with Iran &/or Russia &/or Venezueal could also increase world oil production in the next several years.

At the current oil price US oil production that has been up sharply in recent years IS going to take a dive, since light-tight shale (as well as Canadian oil sand) is not profitable at these prices, and the access for capital for new projects is already drying up. With tight shale 95% of the oil that is ever going to come out of a well has been drawn by the third year of production- to keep shale oil production is a hamster wheel of drill-baby-drill-baby-drill-baby-drill... But without access to capital, drilling stops, and the bankers know how to do the math. Drilling permitting in the US shale plays were off 40% in November, and that was BEFORE oil was doing the limbo on the $60 line. Taking the US shale production off the market is like taking a whole Iraq off the market.

There is strong incentive amongst the major oil producers (including the US oil majors) to cut back to get the price up to where it can make more money. Amongst the nationalized oil companies inside & outside of OPEC many of those countried need $100 or higher oil just to make their national budgets.

This is not a recipe for low and stable oil prices, but rather a recipe for a return to oil price volatility. The relative stability around $100/bbl over the past 4-5 years had been predicted to be stable at that price for the forseeable future by some of the same analysts who are now predicting much lower oil prices for years to come. ( Do they even read their own drivel? They should stop smoking that stuff! Exxon's recently released projections are better than laughing gas!)

Chinese, Indian & US transportation sector policy will have the biggest long term affect on oil prices, but it won't erase the volatility any time soon. China is currently ramping up electric vehicle infrastructure, India & US not so much, but that could change.

|

|

|

|

|

FBBP

Veteran Member

Posts:1215

|

| 15 Dec 2014 08:00 PM |

|

"simply making stuff up"

I totally agree. There is just too many variables to do any crystal ball gazing!

For those of you that like to play the stock market, now would be the time to invest in oil.

As to the cost of material dropping, not yet anyway. Last week we were still paying 1.29 for a liter of diesel. Late in the week it dropped to 1.19. Gas is at .89 to .84.

It takes 4 liter to make a short gallon. |

|

|

|

|

fun2drive

New Member

Posts:68

|

| 15 Dec 2014 08:49 PM |

|

Most transport is driven by diesel not gas so transportation will not change at all. Look at the price difference between the two. I do think fuel process will stay low for a good while until OPEC can drive frackers out of business... |

|

|

|

|

ricky_005

Basic Member

Posts:313

|

| 15 Dec 2014 09:27 PM |

|

Posted By fun2drive on 15 Dec 2014 08:49 PM

Most transport is driven by diesel not gas so transportation will not change at all. Look at the price difference between the two. I do think fuel process will stay low for a good while until OPEC can drive frackers out of business...

Diesel is showing weakness as it should be .... http://www.eia.gov/dnav/pet/pet_pri_gnd_dcus_nus_w.htmlDiesel is how the majority of goods are transported across the world ... the lower it falls, the lower the cost for transporting goods. Areas of the market where competition is strong, you will see a drop in the cost of goods as older higher cost inventories take delivery. There are many different sectors of the economy that will benefit from lower oil cost, as everything has a carbons attached in one way or another. Diesel should follow gas prices ... so far it has been holding up very well compared to gas. I do see the spread widening but still diesel will come down further. |

|

|

|

|

robinnc

Advanced Member

Posts:586

|

| 15 Dec 2014 11:16 PM |

|

Dana....on 60 mins 2 yrs ago, Barbara Walters interviewed several OPEC members. OPEC 'actually' admitted on national TV that it 'only' cost them around 4 bucks to produce a barrel of oil. I read some expert recently said it 'cost' OPEC 70 bucks to produce a barrel of oil. This is nothing but a game from Big Oil making these numbers up!! I know it costs more to drill for oil these days than it did in the past.....but 'every' penny of that is a tax write off. They are still making MILLIONS or BILLIONS at the price oil is now, around 60 bucks. They just don't want the public to know this. Just like any business, the public is 'totally' in the dark about the 'real' cost of 'anything'. Saudi Arabia spends BILLIONS building those man made islands and mansions on them...and MANY other projects......they have MORE money than they know what to do with!!!!!! With the (**(%^$^#%#$* speculators artificially inflating the cost of oil over the past few years...they were 'swimming' in money. That's not supporting the economy, that's 'throwing' money away!

|

|

|

|

|

Bryan1978

New Member

Posts:39

|

| 16 Dec 2014 01:19 AM |

|

I'm surprised not everyone is hearing the same thing we are in the oil biz. What I'm hearing around here is this is us as in our president doing this. Reason being is the issue with Russia and Iran. They both rely heavily on oil being at or above the 100 a barrel. So with oil so low, Russian and Iranian economies fall and the world get what it wants without a war. |

|

|

|

|

Jelly

Veteran Member

Posts:1017

|

| 16 Dec 2014 08:15 AM |

|

So the US president sets the price of oil at will?  |

|

|

|

|

uerling

New Member

Posts:22

|

| 16 Dec 2014 08:23 AM |

|

Heating oil or diesel one in the same will be higher this time of year compared to gas.

|

|

|

|

|

ICFHybrid

Veteran Member

Posts:3039

|

| 16 Dec 2014 09:18 AM |

|

So the US president sets the price of oil at will? He's The Man. Someone has to do it. You know how it works. |

|

|

|

|

Dana1

Senior Member

Posts:6991

|

| 16 Dec 2014 11:39 AM |

|

Posted By robinnc on 15 Dec 2014 11:16 PM

Dana....on 60 mins 2 yrs ago, Barbara Walters interviewed several OPEC members. OPEC 'actually' admitted on national TV that it 'only' cost them around 4 bucks to produce a barrel of oil. I read some expert recently said it 'cost' OPEC 70 bucks to produce a barrel of oil. This is nothing but a game from Big Oil making these numbers up!! I know it costs more to drill for oil these days than it did in the past.....but 'every' penny of that is a tax write off. They are still making MILLIONS or BILLIONS at the price oil is now, around 60 bucks. They just don't want the public to know this. Just like any business, the public is 'totally' in the dark about the 'real' cost of 'anything'. Saudi Arabia spends BILLIONS building those man made islands and mansions on them...and MANY other projects......they have MORE money than they know what to do with!!!!!! With the (**(%^$^#%#$* speculators artificially inflating the cost of oil over the past few years...they were 'swimming' in money. That's not supporting the economy, that's 'throwing' money away!

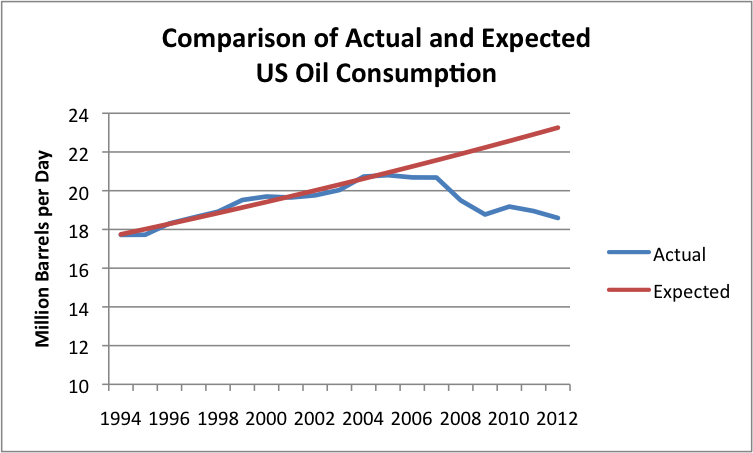

Both $4 and $70 are exaggerations on the actual costs, but the $70/bbl for OPEC oilwould be insane. Yes, OPEC oil is cheap to produce since the sunk capital costs for developing those fields have long since paid off, and may be as low as $4/bbl for some players, but not all. Who was the "expert" with the $70/bbl number for OPEC oil? It actually does cost on the order $70/bbl (+/- $20, depending...) to produce tight-light oil in the US shale fields, which are but a part of the portfolios of the oil majors. The pumping rate from the "mature" oil fields (OPEC and others) is not infinite, and insufficient to keep up with recent growth in world demand. Redevelopment to increase the pumping rates from older oil fields either. (Thing about both the direct and indirect costs of bringing Iraqi oil back onto the world market.) It's the marginal cost of "...the next barrel of oil that it takes to meet demand..." that defines the price of oil. The free market oil majors have been at best treading water or even LOSING money on tight shale, with much lower profit margins than on their legacy oil fields, but since the easy stuff has already been drilled they have little choice but to squeeze what business they can out of the tight-light stuff. It takes on average three years to deplete a shale well- the price can still go up. They have no choice but to pump, but getting financing for more drilling will become impossible if oil prices stay at $60 or less for a long time. Exxon-Mobil may be the worlds largest free market oil company, but still accounts only about 2% of the world oil market. Yes they make numbers up- but it's more about keeping the investors invested. Their profit margins actually go up if they stop fracking, but their overall production rates will fall. But as world production of the expensive stuff falls, demand is likely to catch up. The current glut and crashing oil price is due to the unexpectedly low growth of demand in China, and the decline in oil consumption in Europe & North America. While oil demand has probably already peaked forever in N.America & Europe, it probably still has legs in China and India (accounting for more than 1/3 of the world population, with rapidly growing economies.) It's doubtful that these market circumstances will remain forever. The "real" financial cost of light-tight oil is well understood by the banking sector, who have been raising the alarm with junk-bond type interest rates on those projects for the past few years. Some are pulling out completely, not even lending to those projects until the dust settles on the price volatility. While those companies can still make a decent margin on holes already drilled, at the current price of oil many (possibly a majority) will be a net loss on the project overall if prices don't pick up. New drilling will essentially crash in about 90 days (roughly the period between new permits being issued and the commencement of drilling), and even some of those may see their financing dry up before the rigs set up. The margin the Saudis have been making off their existing oil infrastructure does have them swimming in cash, but their outlandish projects also require a minimum per-bbl price to finance. The Saudi tolerance for lower pricing is much greater than many of the other kleptocracy-country national oil companies, since the national budgets require $100 or higher oil. It's not in the Saudi's interest to invest in more pumping capacity, since they can't fully figure out what to spend the money on even with the current pumping capacity- there is quite a bit of Saudi money invested in offshore real estate and businesses world wide. While OPEC isn't a very efficient cartel, chock full of liars, gangsters and cheats, it would not be unprecedented for them to actually get their act together on pumping rates for some periods of time- it's just been awhile since that happened. It's a cartel easily re-broken, but they still have the ability to cut back production enough to influence the price from time to time, if only temporarily. It's the demand curves in the large developing world countries that drive the price. In 1980 team USA was over 1/4 of the world market for oil, and policy changes here could single handedly break the cartel and did, with fuel economy standards for cars. But the world market share has slipped quite a bit, in part due to even tighter fuel economy standards, using less oil overall since 2006, while at the same time demand continued to increase in the rest of the world. While much has been made of booming US oil production, since about 2006 the US demand has fallen by as much as the US production has increased:   While US oil demand is likely to continue to fall for the foreseeable future, US oil production will only increase if the floor price remains high enough to make a profit on tight-light oil. And that price is no longer in the hands of US policy makers- in the future it'll up to the Chinese & Indian policy makers, since that is where the bulk of the demand growth is coming from. And it SURE isn't up to the board members of the free market oil majors (not even in their wildest dreams)! |

|

|

|

|

Dana1

Senior Member

Posts:6991

|

| 16 Dec 2014 11:59 AM |

|

Posted By Bryan1978 on 16 Dec 2014 01:19 AM

I'm surprised not everyone is hearing the same thing we are in the oil biz. What I'm hearing around here is this is us as in our president doing this. Reason being is the issue with Russia and Iran. They both rely heavily on oil being at or above the 100 a barrel. So with oil so low, Russian and Iranian economies fall and the world get what it wants without a war.

While there may be elements of truth that policy objectives might drive it that way, it's complete BS that the US executive branch has that much control. Yes, the US discussions with Saudi Arabia concerning their common adversary Iran may influence Saudi pumping rates (or not), but that can only influence the price of oil when there is sufficiently weak world demand, which is not in any country's control. US policy is at best a feather on the scale, taking advantage of the current world economy weakness to put pressure on adversaries, but not the ultimate cause of the oil glut. Do you think China was in on the policy-conspiracy too? Chinese policy has more influence over how much the Iranians make on oil than Saudi Arabia or the US, and the Chinese just signed a pipeline deal with Russia. Sure, they'd love to be able to get the fuel at a discount, but I don't see that as being a likely conspiracy. China's slower growth isn't exactly something China wants(it's barely tolerable for them politically), and they surely didn't orchestrate slow economic growth to engineer the price of oil to a new low, even if an oil glut was the result. It's easy for rumors to get going when there is even a scintilla of possibility, but this one is about as plausible as the notion that Saddam Hussein would actually hand over WMDs to the same Al Qaeda that had been calling for his assassination, on some half-baked "enemy of my enemy is a friend" theory. The hit that both Russia & Iran are taking on the price of oil is just a convenient accident of history, from a US & European policy interests point of view. The Ruble hit a new all time low this AM. Russia may very well go into default soon- Russian debt is now paying 17% interest- they'll go bust running the country at credit card type rates, and even that may not be sufficient to stall the fall in the Ruble. |

|

|

|

|

Bryan1978

New Member

Posts:39

|

| 16 Dec 2014 08:43 PM |

|

I didn't think Obama had the power to change oil prices much but when he released our reserves years ago it brought down the price of oil some. And doesn't matter what China does, they too will do anything to avoid conflicts. Anyway, just saying we were told this will only last till summer at the latest. And btw, our invoice for deliveries hasn't changed much in the last 6 months, went up .02 cents a mile. |

|

|

|

|

Bryan1978

New Member

Posts:39

|

| 17 Dec 2014 02:05 AM |

|

I'm not a big political type of guy. I'm rather neutral on many issues that don't pose any immediate threat to my way of life. I work for a large oem here in Houston. We don't drill, we make the equipment used for drilling. We have plants all over the world with 30k employees. I'm just a foreman running a tight shift. When our corporate guys have some meetings and come back and report to use on the floor, it's what we are hearing here. It's not fact nor fiction. Saudi Arabia is our alley and they have been selling their oil at whatever price they want regardless of what the stock exchange says. They started selling their oil for 60 a barrel back in July according to the report I read. So regardless of what oil prices are doing and will do in the near future, my advice is don't get your hopes up. Greed is a natural human instinct. That's why we are on this forum trying to save a buck. That's greed guys. |

|

|

|

|

ICFHybrid

Veteran Member

Posts:3039

|

| 17 Dec 2014 08:50 AM |

|

That's why we are on this forum trying to save a buck. That's greed guys. I'm here trying to avoid the waste of energy so less fossil fuel is used unnecessarily. |

|

|

|

|